Business West’s latest quarterly economic survey has found that almost 60% of businesses – over 70% of manufacturers – are facing pressures to raise prices due to mounting costs of raw materials and energy costs.

More than 430 businesses took part in Business West’s most recent survey of business conditions in the South West, with the findings showing concerns exceptionally high inflation across energy, pay settlements, raw materials and import costs.

Nearly half of respondents have increased their prices over the last 3 months – up 8 points from last quarter, which was already 10 points above Q3 2021 levels.

“We have already seen a substantial increase in energy and material costs to our business and we anticipate this will increase in the double digits for the remainder of the year” James Poeton-Bridgens, Poeton Industries, Gloucester

Aside from supply shortages, many cite rising energy costs and inflationary pressures as key driving factors behind price hikes. Half of respondents expect their energy bill to increase by between 11%-50% year on year in the next 3 months, while 63% are concerned about inflation.

“Energy prices are a massive issue, they’ve gone up by 250%. This is not sustainable” - Lee Strickland, Cohort St Ives, St Ives

As seen throughout 2021, available talent continues to be in short supply with 80% of manufacturers and 69% of service providers struggling to find suitable staff. In addition, retaining staff is proving costly, almost 50% of respondents are facing pressures to raise wages to current staff. The incoming increase in National Insurance contribution rates from next month will add additional tension to this situation, with close to 40% of businesses admitting that this will result in further inflationary pay pressures.

“We have had to offer more to attract the right kind of staff and this will, of course, mean that we will need to increase existing staff wages to maintain the appropriate differentials for staff that have more experience.” – Claire Fish, WatchBattery (UK), Swindon

Looking at the international market, Brexit combined with supply shortages, continues to create challenges for South West exporters. Of the 51% of respondents who sell internationally, 34% have experienced a decrease in their international sales over the last 3 months.

Only 5% of the businesses affected by the implementation of the UK-EU Trade Cooperation Agreement believe that it has had a positive impact on their business activity, one year after its application. 50% of businesses affected have seen a deterioration of their business activity as a result of it.

“Trading with Northern Ireland, where we had established customers, is incredibly difficult to supply due to the onerous paperwork now required around exporting goods.” – Julia Fairchild, Restorative Techniques, Bristol

Domestic sales are looking stronger with 35% of respondents seeing an increase during the past 3 months, despite reporting a deceleration compared to the second half of 2021

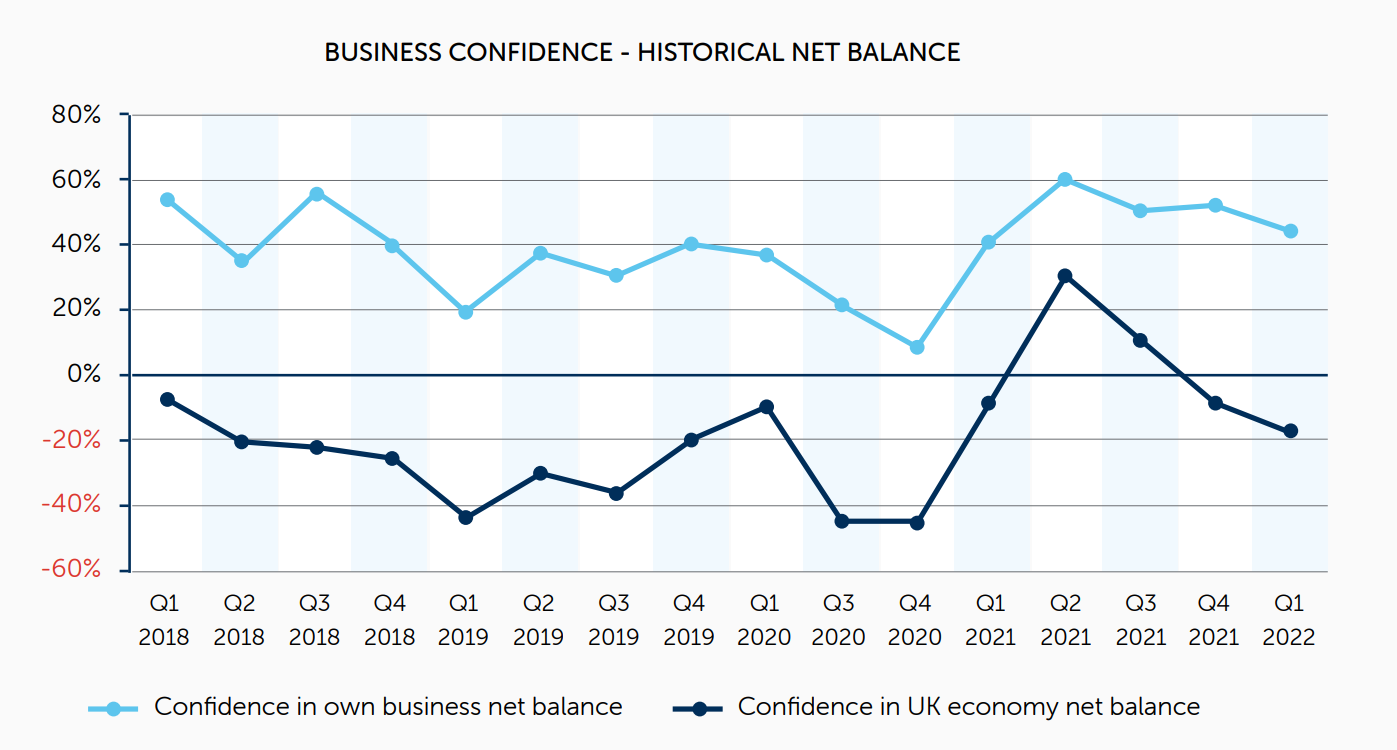

Confidence remains high despite the myriad of hurdles facing businesses. 60% of respondents are confident or very confident about performance prospects for the next 12 months. Confidence in the UK economy prospects presents a weaker outlook, with only 23% of respondents confident or very confident about them. The surge in positive sentiment started after Q4 2020 with the vaccine rollout and economic reopening has stalled or fallen since Q2 2021.

As in previous quarters, businesses feel more positive in sales terms than they do about profitability – implying an expected margin reduction due to exceptionally high inflationary cost base pressures across the board.

“Since everyone is suffering the same issues, we cannot raise our prices to cover for the increasing costs, which means it has to come out of the already receding bottom line.” – Angie Petkovic, APT Marketing, Cheltenham

Business West Managing Director, Phil Smith comments:

"The Government must do all it can to steady the ship and steer the economy through these uncertain times. In 2021 and the start of this year, we have seen strong inflationary pressures, partly due to labour market shortages, but also due to inflation, driven by rising import costs with global supply chain constraints and Brexit.

“The Ukraine crisis adds further pressure to commodity price inflation, particularly to oil, gas and energy costs, and more needs to be done to limit the unprecedented rise in costs facing businesses who are struggling with soaring energy bills.

“The impact of Covid is still being felt by many firms who have been left in a fragile situation. Businesses now need a government that is alert to taking smart short-term measures to help ease the further pressures they face."

We collected responses between the 14th February and the 8th March 2022. The latter part of the survey occurred after Russia launched its war against Ukraine on the 24th February; 92 of the 434 responses were collected after that date. Therefore, this survey may underestimate current business sentiment and the concerns about energy price inflation.

- Log in to post comments