What could small to medium enterprises do with an extra 120 days a year?

That’s how long the average small business currently spends on admin, preventing them from focusing on the real, valuable work of making their vision a reality.

Let’s face it – no one starts their own business because they want to spend their time chasing late payments or creating expense reports. These small tasks can turn into a sizeable, stressful burden.

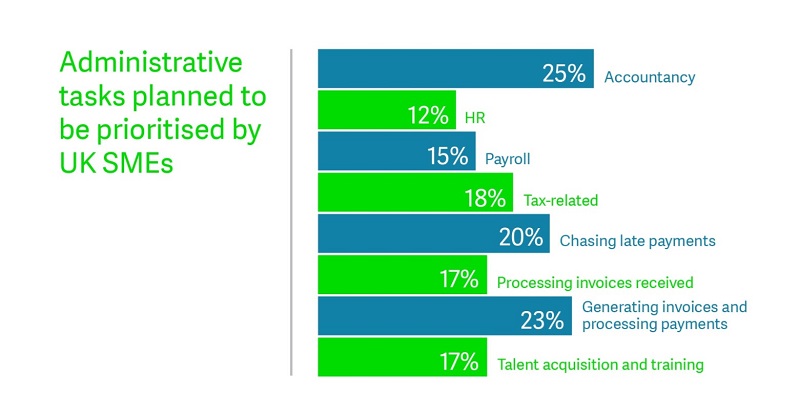

That’s why Sage commissioned a survey of over 3,000 companies across 11 countries to see if technology can be used to lessen this burden, and how governments can encourage its take-up. The survey found that smaller businesses in the UK estimate they spend 71 days on administration tasks each year. That’s more than 14 working weeks, or around three months.

What’s the solution then? How do you reduce admin to make more time to work on growing your business? The good news is that there are effective answers out there. Regardless of their size, most successful companies use two potent solutions to minimise bureaucracy burden.

The first is outsourcing and the second is cloud computing. In light of the recent study, Sage has pulled together some useful tips on the uptake of both of these methods.

Outsourcing your admin

It might sound like a huge oversimplification, but having somebody else do the work is a simple and effective way of minimising your admin - a basic principle behind outsourcing. While many people associate the idea of outsourcing with specific functions, like IT, just about any task on a business’s to-do list can be outsourced.

Take the following steps when planning your outsourcing:

Identify

Put some time aside to identify which tasks you need to outsource, and how much of each task you’d like to do this for. A growing business might want to outsource the management of its HR process, but retain control over running the payroll. Likewise, you can outsource accounting to a bookkeeper but stay in charge of your sales expenditure accounting.

Prepare

You’ll more than likely need to transfer data to the third party you’re outsourcing to, so it’s advisable to put time aside for preparing this. For example, you’ll need to get your accounts into order if outsourcing bookkeeping, plus some extra time for taking your new accountant through them.

Do your research

The best way to find professionals or third parties to whom you can outsource is by asking for recommendations from your peers. You can also ask the person or firm you’re considering if they have any references you can see. Sites such as Trustpilot and Sitejabber can also help by providing user reviews of businesses.

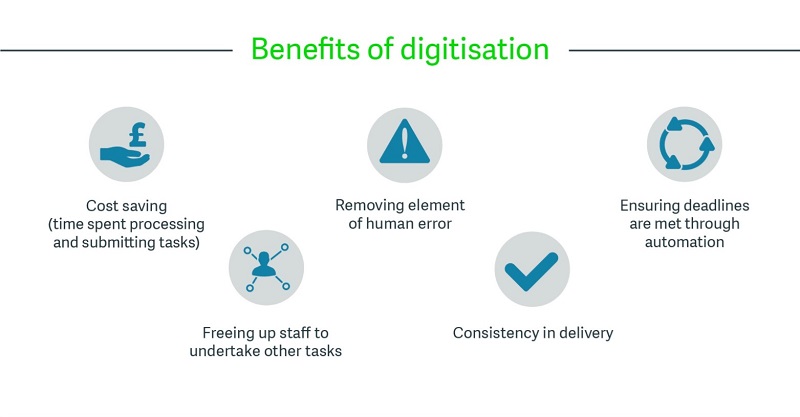

Moving to the cloud

It’s clear that there are inefficiencies that restrict small businesses from realising their potential. However, the burden can be reduced with the adoption of cloud computing. If you’ve already started using the cloud, here’s some advice for making the most of it.

Give it time

Most cloud-based services and apps are built to make the process of admin as simple, intuitive and user-friendly as possible, but you’re still going to have to put in the effort to become proficient at using them. This means taking the time to get good and to incorporate them into your daily work routine.

Collaboration is key

In general, cloud services and apps are designed to encourage collaboration and sharing. For example, you might choose to connect your cloud accounting solution to your accountant’s cloud software to give them access to your data.

Embrace new technology

It’s advisable to try and embrace new technologies in conjunction with cloud-based services and apps - they tend to make life that little bit easier in the workplace. Technology has advanced to the point where one no longer needs a desktop computer or laptop to perform all the necessary tasks.

What steps does your business take in order to reduce the burden of bureaucracy?

More articles from Scott

5 ways to manage your late payments

- Log in to post comments