With the world becoming more digitally focused by the day, the introduction of Making Tax Digital (MTD) is a brilliant opportunity for your business to review and update its accountancy processes. Indeed, moving your accounting over to a digital platform can help make business taxation more efficient, help reduce tax errors, and the government estimates that this change will generate additional revenue of around £610 million in 2020-21.

With MTD for VAT now in full swing and the further digitalisation of business taxes being introduced in the coming years, it’s vital for all businesses with VAT-eligible turnover to be aware of the changes and to fully understand their obligations to remain compliant. However, according to the British Chambers of Commerce, almost half of Britain's SMEs do not believe HMRC provides the necessary support they need to adhere to the current tax system.

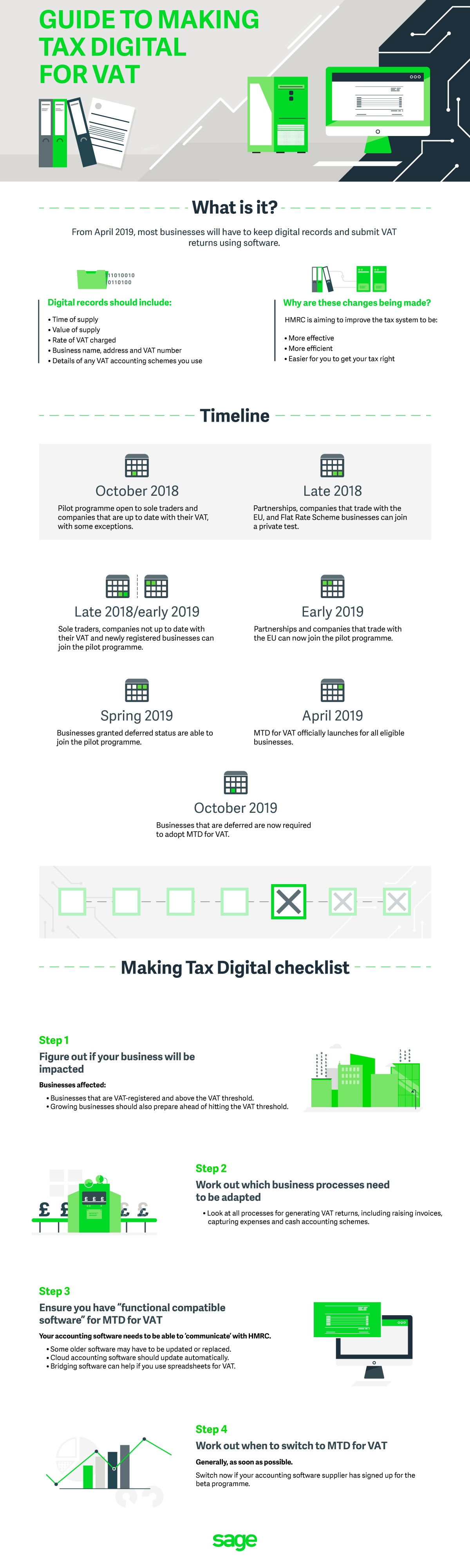

To help businesses of all sizes adapt to MTD, accounting software providers Sage have helpfully put together a visual checklist and guide to MTD for VAT to help you with the initial steps.

In simple terms, MTD requires all applicable companies to do the following from the first day of their first VAT period on or after 1 April 2019:

- Digitally keep and preserve all VAT records set out in VAT Notice 700/22

- Use MTD-compatible software to send VAT returns to HMRC

The introduction of MTD means that if your company is still using spreadsheets or paper-based records, then these are unlikely to meet the requirements set out by the new legislation. Similarly, you must enter every paper-based note or invoice you create into your MTD-compatible software, including the net value, VAT rate and time and date of supply. You can simplify this process by having your software send the invoice itself, and most MTD-compatible software will also record additional information which your business may need to report on depending on your VAT scheme and circumstances.

As with any tax system, there are exemptions, various VAT schemes, surcharges and unique circumstances that may affect how MTD applies to your business so make sure to check with a professional advisor to ensure you fully understand your obligations.

- Log in to post comments

Join the Chamber

Be a part of the largest business membership organisation in the region and tap into a range of valuable business benefits.