Do you always need to use an ATA Carnet for your temporary exports?

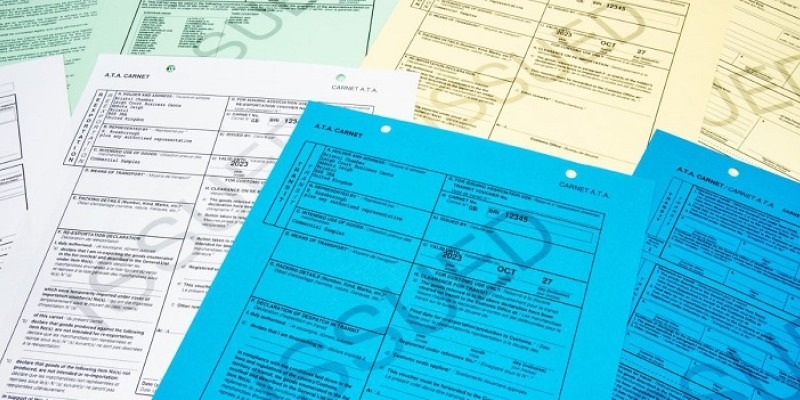

An ATA Carnet, often referred to as a ‘passport for goods,’ is a physical customs document that aids the temporary export of goods from the UK into other countries.

In any instance, an ATA Carnet is not mandatory, and you do not need to use a Carnet for temporary export from the UK. However, for all countries which are part of the ATA Carnet scheme, Carnets are extremely helpful and can often save you a great deal of time and money.

When deciding which method of temporary export to use, you will need to research the country/countries you are travelling to and find out what their specific requirements are.

What are my options if I am travelling to a non-Carnet country? And what are my options if I decide against using an ATA Carnet?

Duplicate list

Duplicate lists are commonly used to temporarily import goods into non-Carnet countries. They are physical lists comprised of all the goods you plan to take abroad, and must be printed on company stationery. Like Carnet lists, they must include detailed item descriptions, quantities, serial numbers (if the goods have them), and values.

In order to arrange a duplicate list, you need to get in contact with the HMRC helpline well in advance of your departure date. You will also need to provide two copies of the list at customs, as well as a filled-in returned goods relief form, and you will need to obtain a customs declaration in conjunction with the duplicate list.

Like ATA Carnets, duplicate lists help you to avoid paying customs duty or tax. However, unlike Carnets, they only relieve customs duties upon your return to the UK (via the returned goods relief procedure). Therefore, it is possible that duties may still be payable when you are importing overseas (i.e. you may have to pay the duty upfront and claim it back in retrospect). Additionally, duplicate lists may only be used for goods carried in baggage, such as the following:

- Items used for professional effects (e.g. tools, survey equipment, film and radio equipment, theatrical equipment, musical instruments, etc.)

- Artworks and other goods for exhibition/display/demonstration

- Trade samples

- Trophies which are the property of a recognised sporting association or organising body permanently established in the UK

Temporary admission procedure

Another alternative method to temporarily export and import your goods is the temporary admission procedure.

It is always worth checking the requirements of the temporary admission procedure with customs of all countries you are planning to take your goods to. This is because each country’s customs tend to have different rules regarding temporary imports. For example, certain countries use procedure codes in order to complete these processes. In addition, you must be authorised by customs to use temporary admission, which involves an application process.

When using a temporary admission procedure, you will also need to have a registered company address in the country you are temporarily exporting the goods to, or a customs agent acting on the company’s behalf. This is because the procedure relies on the agreement that there is always a representative/guarantor who is liable to pay tax and duties should there be any issues (i.e. the goods are not re-exported).

Additionally, if your journey involves travelling via road through European countries, you will also need to make a transit declaration (T1) alongside all relevant import and export declarations. This process will differ from country to country.

Merchandise in Baggage (MIB)

For low-value consignments, you may want to use the Merchandise in Baggage (MIB) procedure. This involves declaring your goods as MIB when you reach border forces.

Although the procedure is called 'Merchandise in Baggage', the goods in question do not actually have to be carried in hand luggage, and can even go up to 1000kg in weight. The MIB procedure only limits the total value of the goods, which must not exceed £1500 in the UK or €1000 in the EU. The maximum value allowed for MIB will differ from country to country, so it is important that you check what this is before you make your journey. You will also need to provide a commercial invoice or similar document to prove the value of the goods.

A major downside of the MIB procedure is that you have to pay tax and duty both when you arrive in your destination country and when you return to the UK, so this method is only viable for very low-value consignments. You may be able to reclaim the tax and duty upon re-importation by applying for returned goods relief, although this process can also be long and convoluted.

Why ATA Carnets?

Despite the options we have considered above, most temporary exporters do however opt to use ATA Carnets when temporarily taking their goods abroad, as the ATA Carnet process saves time and often, money as well.

- ATA Carnets reduce costs to the exporter, as they eliminate customs tax and duties

- ATA Carnets simplify customs procedures, as they are a singular document that can be used for all customs transactions

- ATA Carnets speed up the temporary export process, as you do not need to make advance arrangements to use them

You can apply for an ATA Carnet via our online portal eCert, or get in touch with our specialist ATA Carnet team via email.

If you are planning on temporarily importing your goods into countries that are not part of the ATA Carnet scheme, you will need to use an alternative method to temporary import. If you need assistance with your duplicate list, temporary admission or MIB procedure, please get in contact with our chamber customs team.

- Log in to post comments

Apply for an ATA Carnet today

Start creating and submitting your ATA Carnets today. To apply for your carnet, you'll be taken to our easy-to-use export documentation platform, eCert.