Over the past year, 2.8 million people in the UK claim to be impacted by an incorrect payslip. Due to COVID-19, you may have had to furlough some of your staff or implement pay cuts. These alterations or reductions usually result in changes to take-home pay, meaning coherent and comprehensive payslips are needed now more than ever.

With this in mind, it’s a good idea to ensure your employees fully understand their payslips. Doing so is not only in their best interest but in yours as a business, too. Not only will their understanding reduce the number of questions you or your HR team receive, saving you time, but being open and helpful when it comes to payslips builds trust between you and the employee. The more your employees feel valued, the higher your retention rates will be.

This article will include the information you need to help you improve your payslip process and will share tips on how to help your employees understand their payslips. Within some sections, you’ll find images that we’ve designed for your employees.

Who is entitled to a payslip?

If you employ people who are not self-employed, your workers are entitled to an individual and detailed payslip outlining a breakdown of their pay, including deductions and benefits. This includes casual staff and contractors.

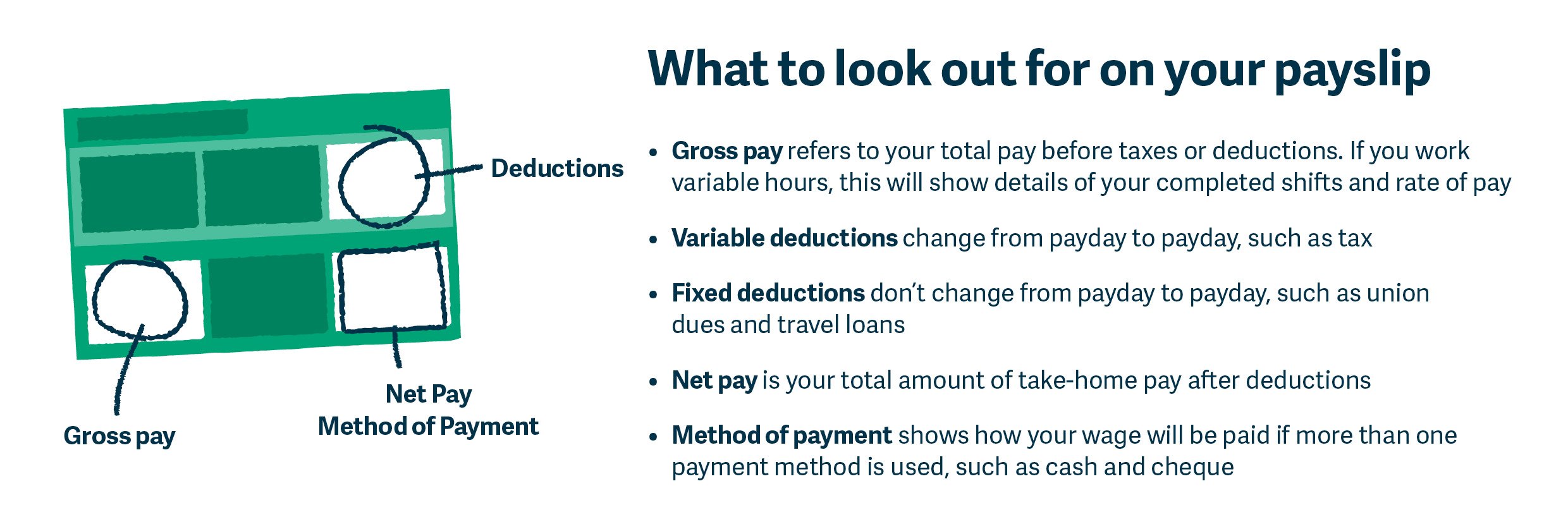

What should be included on a payslip?

As a business, it’s up to you to understand what needs to be included on every payslip to ensure payroll compliance with UK regulations. While payslips may look different, the basic information on them should be the same. At the very least, a payslip should include gross pay, variable deductions, fixed deductions, net pay and method of payment. Payslips may also include tax code, National Insurance number, pay rate as well as any additional payments or deductions, such as overtime, bonuses and pension.

When should employees check their payslips?

Employees should be encouraged to check their payslips every month. However, there are some times when checking a payslip is even more important. These are usually when a change has been made, such as after lengthy sickness or a pay rise, as well as at the start and end of a tax year.

Tips to help employees understand their payslips

1. Digitise and customise

Digitising payslips allows you to automate the process and easily send them out in one go. Most payroll software systems allow you to customise which sections are included to match your employees’ needs and business goals.

2. Simplify

One of the main things that cause employees to ask so many questions about payslips is the overcomplicated language and confusing abbreviations used. If you can, simplify your payslips as much as possible by using easy-to-understand language and clear sections.

3.Explain

Once you have digitised, customised and simple payslips, explain to your employees exactly how their pay is calculated. Go on to include a breakdown of each section of the payslip and the definitions of all the terms.

To do this, you could provide interactive training, create a handy illustrated infographic, or, if your payroll system allows, add comments with explanations.

4. Create FAQs

Writing answers to commonly asked questions and including them within the payroll system allows employees to access the queries of their own accord and get immediate answers.

Some FAQs might include:

-How is National Insurance calculated?

-Who has access to my payslips?

- I’m paying too much tax, who do I contact?

5. Plan for new starters and leavers

When a new employee starts, make sure the payslip process and resources available are baked into the induction. This way, your new employees will have everything they need right from the start and will avoid questions further down the line.

Those leaving the company may have questions about whether they can access their payslips after they’ve left. Whether you need them to download past payslips before they leave or you’ll give them access for a set number of months after leaving, they should be aware of your process.

6. Improve security

Due to the sensitive and personal nature of payslips, employees are usually keen to make sure their information is protected. If your payslips are digitised, employees should have a password to log into the payroll system, providing a good level of security. If you use paper payslips, make sure you have a system in place that employees are comfortable with, such as being given the payslip by hand as opposed to left on their desk in the open.

Improving the safety of payslips is important for your employees, as it allows them to keep a secure record of them and makes sure no detailed information is lost or exposed.

About Sage Payroll:Sage Payroll is a cloud-based payroll solution that caters to small and mid-size businesses across various industries, helping them manage their payroll operations.

Author Biography:

Stacey McIntosh is the editor of Sage Advice UK and Sage Advice Ireland. He has more than 15 years of editorial, PR and social media experience, and has worked across print and online for national newspapers, magazines, PR and marketing agencies.

- Log in to post comments

Join the Chamber

Connect, share & grow - raise your business profile locally & nationally through the largest membership organisation in the South West.

21,000 businesses trust us to help them start, grow, innovate & export - as well as lobby government on their behalf.