In this world nothing is certain, except death and taxes. While not as morbid, managing your business taxes can still be a foreboding prospect. It’s common for small business owners to put it off until the last moment, which can lead to unnecessary fines from HM Revenue and Customs (HMRC).

You can hire an accountant to help you stay compliant and seek potential savings but it’s also possible to do it yourself. Accountancy software specialist Sage has identified three key areas those managing their own taxes need to address: Self Assessment, VAT and Corporation Tax.

Self Assessment

Self Assessment is a system HMRC uses to collect income tax. After choosing your business type, you’ll need to register with HMRC to file your own personal taxes. Register as quickly as possible once you have chosen your business type as HMRC can impose fines.

You can send your personal tax return using HMRC’s online service or in paper form, however, it must be received by the relevant deadline date. Based on what you report, HMRC will calculate what you owe.

Value Added Tax

Most consumers in the UK are used to paying Value Added Tax (VAT) as it’s charged on most goods and services sold by VAT-registered UK businesses. VAT is collected on behalf of HMRC by registered companies. Therefore, it’s necessary to charge the applicable tax rate for any products or services you sell.

The rules on VAT are dependent on how much your business makes. Companies earning more than £85,000 over a 12-month period will need to register for VAT. However, voluntarily registration when you earn below that may add to your business’s professionalism and lets your company reclaim the value of VAT on certain items. It’s also beneficial to check to see if there are any VAT schemes which can save you money.

When it comes to submitting a VAT return, it’s necessary to do so electronically at regular intervals.

- HMRC has a free online service which allows you to enter the values manually.

- Alternatively, you can use any accounting software which has been approved by HMRC to send your VAT return directly to the gateway. Software, such as Sage One, will produce VAT Returns with ease and store previous returns for you to view at any time.

- However, if you don’t have time you can authorise an agent or your accountant to submit your VAT return on your behalf.

It’s important to stay compliant with VAT legislation as HMRC can inspect your VAT records for accuracy at any time and can impose penalties for any inaccuracies. Using software that creates invoices is the best way to make sure your invoices are always compliant. There are two key things to bear in mind:

- You must keep your VAT records for at least six years. You can store them in paper form, electronically or within software. Records must be accurate, complete, and accessible.

- You need to make sure you create official VAT invoices.

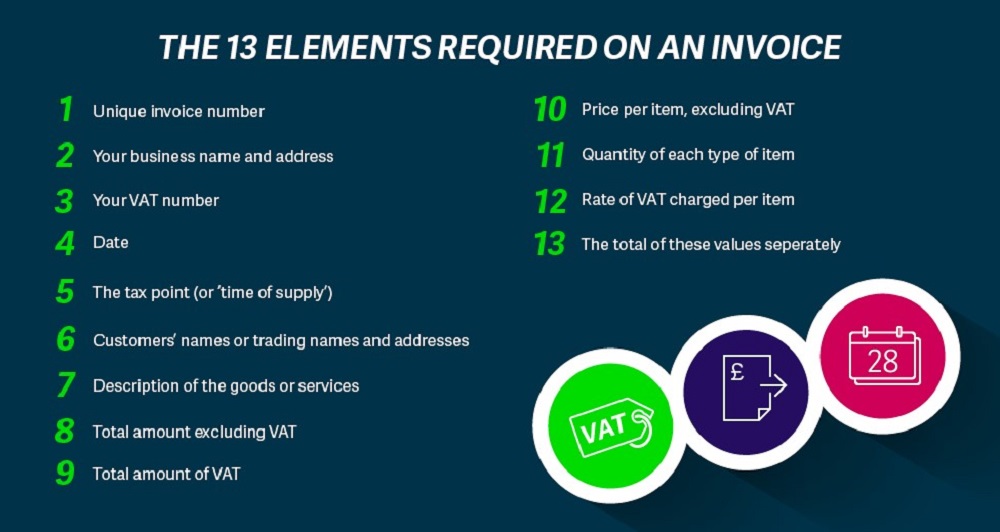

The following 13 elements must be included on an invoice for it to comply with VAT regulations

Corporation Tax

Corporation Tax is paid on any profits your business makes above a certain threshold. It applies to limited companies and unincorporated bodies, such as a clubs, societies or co-operatives based in the UK. Taxable profits include any income your company earns from selling your products abroad. Enterprises that aren’t headquartered in the UK but operate here will also have to pay corporation tax on profits arising from UK activities.

As an owner of any of these business types, it’s your responsibility to calculate and report on your Corporation Tax. In order to be compliant, you need to tell HMRC that your company is liable for Corporation Tax within three months of starting. You will also need to make the correct payment amount before the deadline date. Finally, you’ll need to file a Company Tax Return and supporting documents within your accounting period.

If you need additional help with Corporation Tax, you can:

- Appoint an accountant or tax adviser to help you

- Contact the HMRC helpline

Read more in our series from Sage:

Choosing a business type when starting a business

- Log in to post comments