Starting a new business requires you to make several tough decisions almost from the offset. Indeed, one of your first major choices is which business type best suits your company’s goals. This choice will impact on most parts of your new enterprise, from its name to its accounting liabilities. While the differentiating between the types of business can be confusing, each comes with certain benefits and hindrances to budding entrepreneurs.

Whether you’re doing it alone or banding together with others to make your venture a success, it’s vital you’ve fully understood your obligations before settling on a particular type. To help, Sage has put together a guide to the main options available for future tycoons.

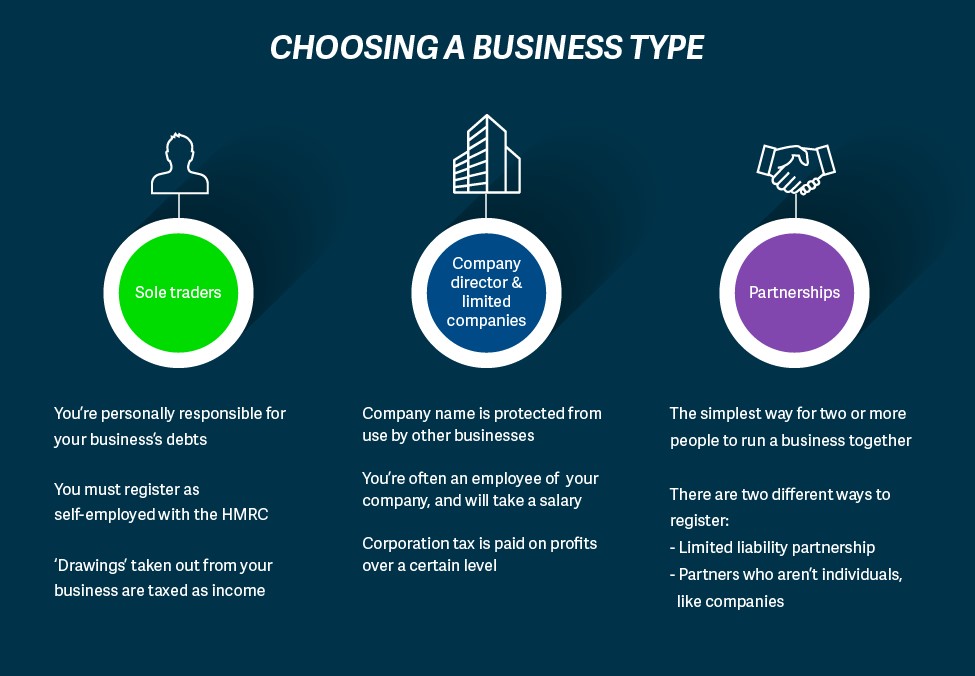

Sole trader

As a sole trader, you run your own business. As a result, you’re personally responsible for your company’s debts. One advantage of starting as a sole trader is that it’s very simple to set-up - all you have to do is register as self-employed with HMRC and ensure that your business insurance covers you. However, it’s important to note that registering as a sole trader doesn’t protect your company name.

With sole administrative power come additional accounting responsibilities. You need to keep records of your business’s sales and expenses and send a self-assessment tax return once a year. You will be paid in ‘drawings’ from the firm which are taxed as income. These ‘drawings’ are on average at a lower rate than company directors who are taxed less on their dividend payments.

Company director and limited companies

Choosing to start a limited company is not as simple as being a sole trader. It requires you to create a company name and register it with Companies House, along with your incorporation documents. However, registering in this way means your enterprise's name is placed on the Register of Companies, protecting it from being used by other companies. You’ll also receive a certificate of incorporation and your unique company number.

The finances for a limited company can be a lot more complicated than that of a sole trader. Firstly, you need to register for corporation tax within three months of starting trading. Companies only pay these taxes once profits are above a certain level, with limited companies benefitting from some tax reliefs.

Company directors are often an employee of their business meaning they're paid both a salary and dividend payments. As discussed above, this means they do not attract as much tax as sole traders. Typically, with this increased complexity, directors will hire an accountant to ensure their books meet all legal obligations.

Partnerships

A partnership means that two or more partners are running a business together. A partner can be both an individual or a company. Partners share responsibility for the firm’s debts and have many accounting responsibilities. It’s also the nominated partner’s responsibility to register the partnership in one of two forms:

Limited liability partnership (LLP):

Each member of an LLP is either a person or a company (known as a ‘corporate member’). This set-up means that each member pays tax on their share of the profits but isn’t personally liable for any debts the business can’t pay.

In order to register as a LLP you must:

- Choose a company name

- Have a registered address - this will be publicly available

- Have at least two ‘designated members’

- Have an LLP agreement that says how the LLP will be run

- Register the LLP with Companies House

Partners who aren’t individuals, like companies:

In this instance, the business is legally separate from the people who run it. This means company finances are separate from personal ones and any profits can be kept after taxes.

In order to register as partners you must:

- Choose a company name

- Have a registered address - this will be publicly available

- Have at least one director

- Know the details of the company’s shares and you’ll need at least one shareholder

- Know the details of your SIC code as this identifies what your company does

Once you’ve decided on a business type and registered it, you can congratulate yourself as you’ve taken a major step forward in ensuring that your new venture has solid foundations on which to grow.

- Log in to post comments